NBA Team Mines Ethereum

June 29, 2018 Harry DeVries 0 Comments

What Is a Decentralized Autonomous Organization?

June 21, 2018 Harry DeVries 0 Comments

North Carolina Banking Bill Passes — Adds Virtual Currency License Requirements

June 21, 2018 Harry DeVries 0 Comments

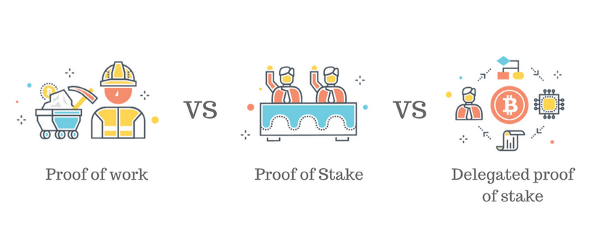

Delegated POS vs POW and why Ripa Exchange is on the right track

June 14, 2018 Harry DeVries 0 Comments

Proof of Work can be thought of as the traditional method Blockchains use to validate and finalize transactions. In fact, many of the major cryptocurrencies still use this methodology including Ethereum and Bitcoin.

The way Proof of Work validates blocks:

Miners within the system are required to process and finalize transactions using very complicated algorithms. This has an immediate and somewhat counterproductive impact on the performance of the network as a whole. This is also one of the reasons why Bitcoin is yet notorious for serious delays when completing transactions.Although many still the advantage of such a system enhances network security making it virtually impenetrable. But it places undue strain on electricity, requires plenty of workspace, and demands extra cooling as well.

How DPOS is different to POW and POS?

Delegated Proof of Stake, and DPOS for short takes a completely different approach to transaction validation. The first difference is that miners are chosen specifically who hold fair amounts of tokens on the network. And they are rewarded with amounts of the cryptocurrency for the duties of producing blocks and confirming transactions.

The incentives, therefore, provide a layer of social trust across the entire network. But the biggest benefit is that DPOS turns out faster with this

streamlined approach.

Why DPOS is better then POW

Clearly, the greatest advantage DPOS has over POW is speed. Transactions can now be completed in seconds. And thousands of transactions per second do not stress the network in any noticeable ways.Energy requirements are also significantly cut down, and the system is more efficient overall. The best part is security is not hampered in any way. DPOS is also way more decentralized than POW.

How RIPAEX working on DPOS is a very solid and innovating project

Ripa Exchange — which promises to remain free of charges to its constituent membership, is making exclusive use of the DPOS protocol. This will ensure transactions are quick, secure and with many extra benefits to its members.

With DPOS people are not randomly selected for the purpose of delegation. They are voted in by existing members of the network. Those with the most votes are called Witnesses.

In a sense, the network is run mainly under the direction of ordinary people. There is a bold spirit of democracy inside the system of DPOS which encourages miners to prove themselves.

As the network gets bigger, Witnesses find themselves competing with one another. This results in each of them trying to perform better as time goes on. They also have to pay attention to following set protocols, since they are in a sense governed by the people in the rest of the network. This helps to keep everyday operations running fair, compliant and efficient.

Hurry! Join the RIPAEX presale now and receive 100% bonus http://www.ripaex.io

RIPA BOUNTY Campaign:

Participate in the bounty campaign and reserve yourself a slice of the ₱3,750,000 XPX allocated!!https://bitcointalk.org/index.php?topic=4447278

Thomson Reuters to Track Top 100 Cryptocurrencies

June 14, 2018 Harry DeVries 0 Comments

Coinbase Acquires Investment Firms to Offer Regulated Crypto Securities

June 07, 2018 Harry DeVries 0 Comments

Top Ways Blockchain Tech Is Changing Social Media

June 07, 2018 Harry DeVries 0 Comments

Search

Popular Posts

-

Bitcoin, the famous cryptocurrency or the currency of Internet has taken the world by storm and is soon turning into a real currency! Tradin...

-

TAAS — token as a service, is a whole new project which gives bitcoin and crypto currencies a whole new perspective. Quickly read mor...

@CryptoCoinsRev

Blog Archive

-

▼

2018

(105)

-

▼

June

(8)

- Pornhub Adds New Tokens, Fcoin Defends Trans-Fee, ...

- NBA Team Mines Ethereum

- What Is a Decentralized Autonomous Organization?

- North Carolina Banking Bill Passes — Adds Virtual ...

- Delegated POS vs POW and why Ripa Exchange is on t...

- Thomson Reuters to Track Top 100 Cryptocurrencies

- Coinbase Acquires Investment Firms to Offer Regula...

- Top Ways Blockchain Tech Is Changing Social Media

-

▼

June

(8)